Breaking News

PDP’s Rebuilding Strategy in Enugu State

When Elders Feast While the Youths Burn: Ohanaeze’s Shameful Betrayal of Ndigbo!

Enugu Now the Beacon of Renewed Hope — Thanks to Mbah’s Leadership and Nwoye’s Tactical Genius

Defection Fever: Why Blind Followership Could Cost You Your Political Future

DAWN OF A NEW ERA: ENUGU YOUTH FORUM SENDS MESSAGE TO DR. BEN NWOYE

Uzodimma Loses Grip: Ben Nwoye Breaks the Chains of APC Enugu Captivity

“A New Dawn in APC Enugu: Prince of Amuri Kingdom, Dr. Ben Nwoye, Rises Again as Caretaker Chairman

APC Enugu in Total Disarray as “Sleeping Minister” Bows Out in shame Over Fake Certificate Scandal

Aninri 11th Legislative Assembly Reduced to a Rubber Stamp – Fails in Oversight Responsibility

DNA Test Should Be Made Free for All Nigerians – The Voice of the Masses Urges FG

ANINRI LAND REGISTRY BILL CRASHES: EXPOSING THE LEGISLATIVE LEADER’S INCOMPETENCE & INCAPACITATED

Tomorrow Is Here Movement Aninri Chapter Urges Ndi Aninri to Embrace Voter Registration

Senator Osita Ngwu Extends Solar-Powered Borehole to Amagu Okpanku, Aninri LGA

Aninri Talent Display 2025: Showcasing the Future of Entertainment in Enugu State

Unity of Purpose: Gov. Peter Mbah & Senator Osita Ngwu, A Dynamic Duo for Enugu’s Transformation

Idoma Council Nullifies Chieftaincy Titles Bestowed on Tinubu, Others in Benue

ADC Challenges INEC: How Did Osun Register More Voters in Seven Days Than in Four Years?

Senator Osita Ngwu Honoured with Distinguished Education Leadership Award

Tragedy on Enugu-Port Harcourt Express Road as Truck Conveying Goats to Enugu Overturns

Politics of Second Tenure in Aninri: The Injustice Against Late Hon. Bennett Ajah

Enugu North LGAs Receive Over ₦30 Billion in 11 Months – But Where Is the Development?

Enugu North LGAs Receive Over ₦30 Billion in 11 Months – But Where Is the Development?

2027 Elections: “No Room for Mistakes” — INEC Nigeria’s Final Warning

The Significance of the Name Peter Mbah in APC, Enugu State Chapter

2027: Peter Mbah vs Wike — The Battle for Political Survival

Dr. Ben Nwoye Returns to APC as Governor Peter Mbah Finalizes Move to Join the Party

Nkwo Market Obeagu Oduma: The Heartbeat of Agricultural Trade in Aninri

Peter Obi Set To Return To PDP, Get Automatic Presidential Ticket — Says Ex-Governor Modu Sheriff

Atiku Vows to Deliver Ekiti to ADC in 2027, Tells Governor Oyebanji to Prepare Handover Notes

Senator Osita Ngwu Reaffirms Commitment to Timely Completion of Enugu West Constituency Projects

Another Smart School Collapses in Enugu: Achi Uno Ward 2 Site Fails Structural Integrity

Peter Obi Responds to Edo Governor Okpebholo: “I Don’t Need Clearance to Visit Any Nigerian State”

Tinubu Govt. Develops Southern Nigeria, Neglects the North – Says Kwankwaso

₦4 Billion Fraud Case: Court Sets November 25 for Trial of Ex-Anambra Governor Willie Obiano

Enugu Electricity Commission Clarifies Tariff Reduction: “We Didn’t Alter National Power Costs”

MASSIVE DEFECTION ROCKS PDP IN IGBO-EZE NORTH LGA: APC GAINS MOMENTUM AHEAD OF 2027

Senator Osita Ngwu Urges FG to Release Funds for Completion of Abandoned Enugu-Onitsha Road Project

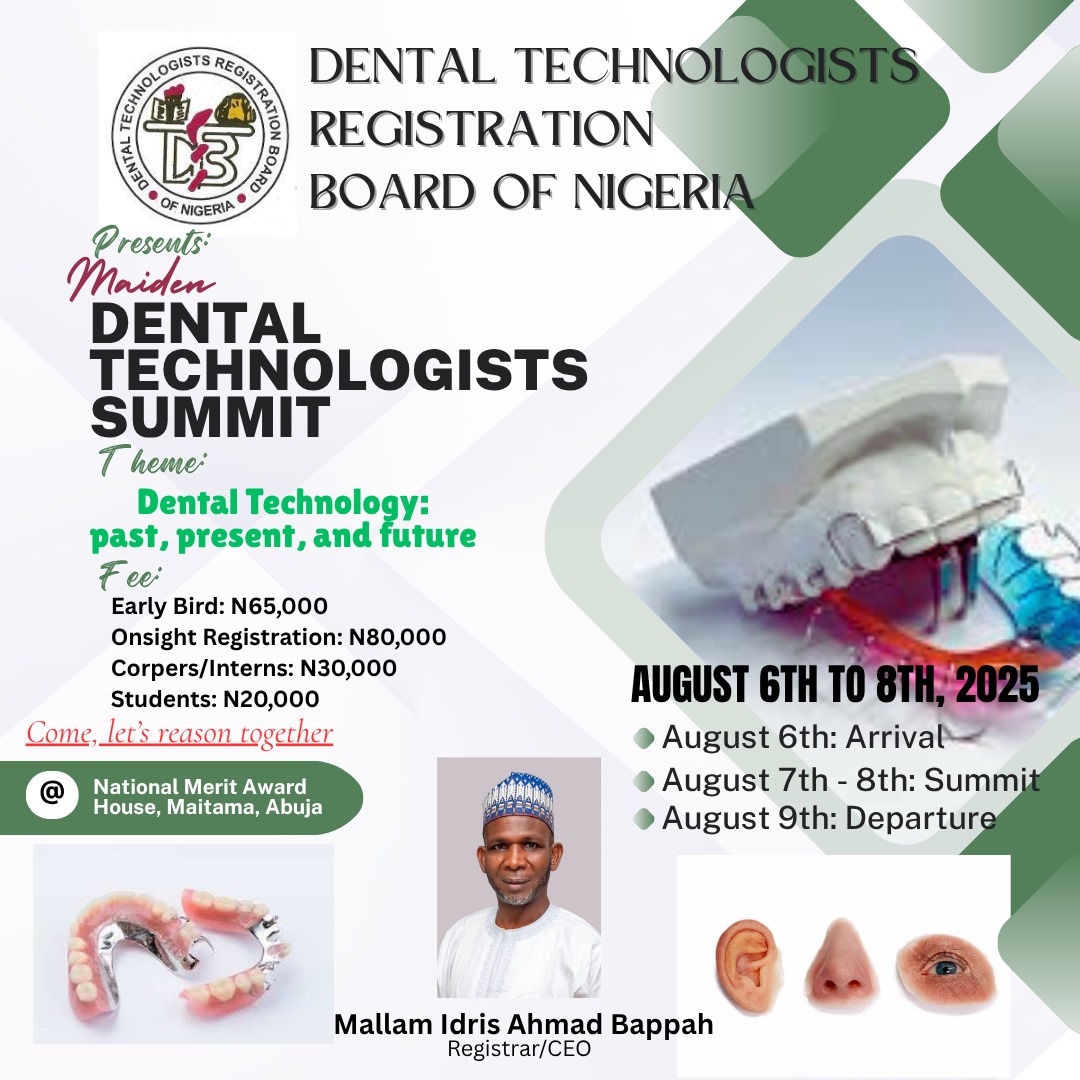

ADVERT NEWS: Maiden Dental Technologists Summit Holds in Abuja

Happy 64th Birthday to His Excellency Peter Obi – Okwute Ndi Igbo!

Tinubu Panics Over ADC Mega Coalition: As The Shape Of 2027 Begins To Form

A section of the smart -school at Isi-uzo LGA Mbu ward 11 collapses

Edo Governor Bans Peter Obi from Entering State, Cites “Security Threat” to His Life

Why Governor Peter Mbah May Consider Joining the ADC Mega Coalition Amid PDP Crisis

2027 Election: Why Only a Northern Candidate Can Defeat Tinubu’s Government

Breaking: Atiku Abubakar Dumps PDP, Joins Forces with Obi, El-Rufai, Amaechi in ADC Mega Coalition

How PDP's Leadership Crisis is Paving the Way for Hon. Edeoga's 2027 Gubernatorial Ambition in Enugu

Wike’s Withdrawal from G-5 Over National Secretary Crisis Deepens PDP’s Internal War

A Trailblazing Year: How Senator Osita Ngwu is Redefining Leadership in Enugu West

Aninri Mourns Hon. Bennett Ajah: A Pillar of Hope and Legacy of Leadership

Breaking: Ratify Udeh-Okoye as National Secretary or Face Mass Exit, S.E Threatens PDP

Rotimi Amaechi: “Lamido and I Would Have Challenged Tinubu’s Government If We Were Still Governors

Breaking news: Aninri Impeachment Saga: Hidden Truth Behind Hon. Philip Igwe's Removal Unveiled

The Giant Stride of Senator Osita Ngwu: Transforming Enugu West through Leadership

ADMINISTRATIVE HOSTAGE OF COUNCILORS BY THE LG CHAIRMEN IN NIGERIA .

Honoring the Legacies of Late; Hon. Mathias Ekweremadu (Eze Igbo) in Aninri and Enugu State

Breaking: Enugu West Unity Forum Endorses Governor Peter Mbah for Second Term in 2027

Breaking: Enugu West Unity Forum Endorses Governor Peter Mbah for Second Term in 2027

Breaking: The Pertinence of Electing His Excellency Governor Peter Mbah for a Second Term

Celebrating the Excellent Leadership of His Excellency Governor Peter Mbah

Governor Mbah Has Developed Enugu State Beyond Party Lines – APC Chieftain Senator Utazi

BREAKING: DEVELOPMENTAL STRIDES: HON. ENG. ANAYO ONWUEGBU'S PROJECTS BRING JOY TO AWGU TOWN

The Rise and Fall of APC in Enugu State

The Rise and Fall of the Labour Party in Enugu State

Breaking: Crisis Looms in Ameke Oduma Autonomous Community Over Power Tussle for President General

Bringing to Light a Refined Character Trait of Honorable Dr. Joe Chukwu: A Portrait of Integrity

Simon Ekpa Faces Justice: Finnish Court Approves Extradition to Nigeria

BREAKING: Federal Court Orders Removal of Tinubu-Appointed Sole Administrator in Rivers State

Breaking: Tinubu Presidency Dismisses U.S. Drug Allegations as Non-Actionable

Breaking: U.S. Court Orders FBI, DEA to Release Files on President Tinubu Tied to 1990s Drug Probe

Obeagu Oduma Cultural Day Celebration 2025: A Grand Showcase of Heritage and Tradition

The Return of Hon. Edeoga: A Testament to Governor Peter Mbah’s Leadership and Unity

Applauding Honorable Ikenga Ugochinyere for His Bold Steps Towards the Release of Mazi Nnamdi Kanu

Applauding the Leadership of Distinguished Senator Osita Ngwu – The People's Senator

Baba One Nation: A Legacy in Music and the Grand Launch of a New Era

HOW JONATHAN VOLUNTARILY AND PEACEFULLY HANDED OVER POWER TO BUHARI IN 2015

Just In: Enugu State Govt, LG Councils Target Establishment of 260 Farm Estates

AN "AUGUST VISIT" TO HON. CHIJIOKE EDEOGA FOR HIM TO RETURN BACK TO THE PDP

RECAP ON VISIONARY STEPS TOWARDS GREATER AGWU TRANSFORMATION AGENDA BY HON ENGR ANAYO ONWUEGBU

Breaking: Fresh insecurity looms in Aninri as suspected fulani herdsmen murdered Aninri son

48 thousand overcrowded inmates awaiting for trials in Nigeria Prisons – NCoS

Governor Mbah’s Aide, Prof. Okereke Celebrates Father’s 87th Birthday with Inspiring Book Launch

Just In: Tinubu led government submit Extradition Requirements for Simon ekpa To finnish Government.

Sad news: Many Persons Dead In Anambra During Stampede At Rice Sharing Event In Okija

Russian-ukraine war: I'm ready to meet Donald Trump For Negotiations president Putin Said.

Just In: Lagos Mosque pull Down 'Jesus Christ is Not God' Banner After Backlash

Heavy security in national Assembly as president tinubu presents 47trillion Naira 2025 budget

Breaking: Amidst cashless policy CBN Limits POS Daily Withdrawal To N100,000

HON. MAGNUS EDEH AND HYPOCRISY OF GRATITUDE

Breaking: Edo Assembly Suspends 18 Local Government Chairmen, Vice Chairmen

Release hostages Trump issues warning to Hamas; says refusal to do so would be unpleasant.

WHY DO PEOPLE CHANGE WHEN THEY ASSUME POSITIONS OF POWER ?

JUST IN: ECOWAS Approves Withdrawal Of Niger, Mali, Burkina Faso By January 2025

JUST IN : ENUGU PDP WOMAN LEADER BAGS HONORARY DOCTORATE, SALUTE USA UNIVERSITY

Just In: south Korean Parliament Impeaches President Suk Yeol Amid Martial Law Crisis

CBN Confirms Old N1000, N500, N200 Notes Remain Valid

JUST IN: REPS ORDERS CBN TO INVESTIGATE THE ALLEGED NAIRA SCARCITY BY COMMERCIAL BANKS

Just In: PDP Appoints Ikenga Imo Ugochinyere as Party Leader in Imo State

Just In: Donald Trump To Sign Executive Order Removing Transgender Personnel From US Military

Hon. Ugochukwu Nwanjoku ( Ndumeze jnr) : A Visionary Leader Transforming Aninri Local Government

Just In: Court Of Appeal Upholds Rivers State Council Elections Conducted By Governor Fubara

Breaking: National Assembly Passes Bill For Life Imprisonment For Nigerian Drug Traffickers

BREAKING: Simon Ekpa Will Be Extradited To Nigeria To Face Charges — Defence Headquarters Says

Eulogizing Prince Ugochukwu Nwanjiku: A Visionary Leader Transforming Aninri Local Government

No Excuses From Nigeria To Boycott Match, Libya Says As Players Continue Training

Just In: Thailand Returnee Arrested With N3.1Billion Heroin At Lagos Airport

Breaking: Tinubu Takes Brand New Jet To China To Borrow Money,’ Adeyanju Knocks Nigerian President

Congratulations to Hon. Ugochukwu Stephen nwanjoku( Ndumeze jnr) for a victory well deserved.

Just In: Bobrisky, VDM, lawyer arrive for Reps’ probe

FG: Breakdown of salary structure for workers as new minimum wage implementation begins

Breaking: Nigerian Man Tied To Luggage In Car Boot Over Hike In Transport Fares

Enugu poll: list of the 17 LG chairmen elect

JUST IN: *ANINRI CHAIRMAN -ELECT RECEIVES MONARCH IGWE ACHARA 1 OF ODUMA ACHARA

Breaking: Bandit Leader Calls for Kidnapping of President Tinubu

Edo Poll: INEC Is Nigeria’s Most Dangerous Institution, Davido Says In Face-off With Police

Enugu LG polls: Jubilations in Aninri as ENSIEC Declared Nwanjoku winner

Aninri poll: PDP on lead across the 10 wards of Aninri as voting is successfully ongoing.

Breaking: suspected hoodlums set ablaze Gov. Mbah fuel station, pinnacle oil limited.

"I'm a chosen"- cubana chief priest reacts after LASEPA shuts down his nightclub in lagos

Just In : Ganduje debunks any alleged involvement in fresh plot to dethrone Sanusi

HON. UGOCHUKWU NWANJOKU THE PATHWAY TO A NEW ANINRI

*UNITED ANINRI 2024 Prince Ugochukwu Nwanjoku Takes Campaign to Nenwe Wards

Just In: Ogbete market chairman Mr Stephen Aniagu shot dead

BREAKING: DINO MELAYE FACES SUSPENSION OVER ANTI PARTY

Breaking: Nigeria CBN Issues New Directives Over POS Transactions

Oshiomhole's politics of Deception

United Aninri 2024. Hon. Ugochukwu nwanjoku for a new Aninri, hope for Agricultural development.

Happy birthday to an exceptional leader per excellent Hon. Eng. Emmanuel okoro elder state man

Enugu LG polls: ENSIEC vows to conduct free, fair and credible LG elections in the state

BREAKING: ANINRI PDP EXTENDS OLIVE BRANCH TO MEMBERS,CALL FOR UNITY OF THE PARTY

A credible leader par excellence is needed for Aninri’s project

UNITED ANINRI 2024.HON UGOCHUKWU NWANJOKU FOR CHAIRMAN HOPE FOR ANINRI SPORTS DEVELOPMENT

NDI ANINRI BETTER DAYS AHEAD WITH THE INCOMING CHAIRMAN HON. UGOCHUKWU NWANJOKU

Just In: DG VON Osita Okechuwu To President; Don’t allow special interests kill your achievements

LG chairmen, councilors to enjoy four-years tenure.

Breaking: Simon Ekpa's biafra agitation Lands him in court, as Finland takes actions

JUST IN: FG EXPLAINS WHY LG FINANCIAL AUTONOMY WON'T TAKE EFFECT IMMEDIATELY

JUST IN: THE SUPREME COURT CLARIFIES TENURE OF LG CHAIRMEN, COUNCILLORS

BREAKING: GOODLUCK JONATHAN'S 2027 PRESIDENTIAL CAMPAIGN POSTER SURFACES ONLINE

JUST IN: GOV. MBAH FLAGS OFF DISTRIBUTION OF N4.6BN WORTH OF AGRO INPUTS, MSMEs GRANTS

BREAKING: AHEAD OF PDP PRIMARIES, GOV. PETER NDUBISI MBAH HOLDS CRUCIAL STAKE HOLDERS MEETING

JUST IN: UMAHI LAUDS GOV. MBAH'S PARTNERSHIP WITH FG TO FIX SOUTHEAST ROADS

PARTICIPATION IN POLITICS AND THE POLITICAL PROCESSES, NOT NEGOTIABLE. GET INVOLVED

JUST IN: AN APC CHIEFTAIN SENATOR IFEANYI UBA DIED IN A HOTEL IN LONDON, THE UNITED KINGDOM.

JUST IN: NATIONAL ASSEMBLY PASSED THE NEW MINIMUM WAGE INCREASE FROM #30'000 NAIRA TO #70,000 NAIRA

FAILURE TO PARTICIPATE IN POLITICS YOU WILL END UP BEING GOVERNED BY YOUR INFERIOR

ANINRI PEOPLE'S FORUM HOW MARKET ?

JUST IN: REPS ORDERS CBN TO INVESTIGATE THE ALLEGED NAIRA SCARCITY BY COMMERCIAL BANKS

Leave a Reply

Your email address will not be published. Required fields are marked *